London, UK – The collapse of luxury jewellery chain Vashi has been exposed as one of Britain’s largest financial frauds, leaving investors, staff, and customers cheated out of more than £170 million. A BBC Panorama investigation has revealed how founder Vashi Dominguez staged elaborate deceptions to secure cash from high-profile backers before disappearing in 2023.

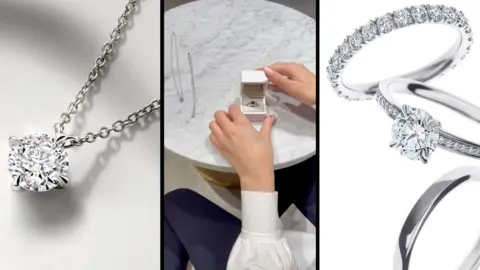

Former employees disclosed that staff were ordered to pose as customers in Vashi’s London stores to create the illusion of booming trade whenever potential investors visited. Some were even told to sit at jewellers’ benches pretending to set diamonds or craft jewellery. “It was a whole elaborate show… a total façade,” recalled former store manager Will Hayward.

The deception helped Dominguez attract millions from seasoned investors, including Pret a Manger’s former CEO Clive Schlee, billionaire John Caudwell, and GB News co-founder Mark Schneider. “Some smart guys were in the deal, so I went along with it. It seemed good,” Schneider told Panorama, admitting he lost £750,000.

False Accounts and Fake Valuations

At the heart of the fraud were falsified accounts and inflated valuations. While official records submitted to Companies House claimed Vashi had generated sales of more than £100 million in 2021, internal documents later revealed actual sales were closer to £5 million.

Customers were also misled. Former staff say the company frequently supplied lower-quality diamonds than buyers had paid for, even scratching off GIA certification numbers to disguise the deception.

When Vashi collapsed in April 2023, investors were reassured that the company held £157 million worth of diamonds. An independent valuation, however, found stock worth barely £100,000. “Our first question was actually to ask if there was any more,” said diamond consultant Rob Wake-Walker.

Lavish Lifestyle, Empty Accounts

Despite his company’s financial ruin, Dominguez reportedly enjoyed a lavish lifestyle funded by investor money. The company paid for luxury apartments in Mayfair, a fleet of cars including a Lamborghini, and an extravagant Covent Garden flagship store featuring an £8,000 sofa and interactive screens.

Yet bank records reviewed by liquidators showed no evidence of large sums being siphoned offshore, raising questions about where the money actually went.

Dominguez vanished the day a court ordered the business wound up, with records showing he flew to Dubai. Private investigators have since reported sightings, but his precise location remains unknown.

Authorities Under Fire

Despite the scale of losses, neither the Metropolitan Police nor the Serious Fraud Office (SFO) has opened an investigation. Investors say they have been passed between agencies, with the SFO claiming the case was not “complex enough” for its remit.

“This is bigger than Hatton Garden, Brink’s-Mat, and the Great Train Robbery combined,” said advertising executive and investor Michael Moszynski. “Yet nothing is being done.”

Mark Schneider, who also lost his investment, expressed disbelief at the authorities’ inaction. “All these people in your country can be ripped off in such an obvious way, and you don’t bother trying to find the per

son or deal with the fraud,” he said.

The Perfect Disappearance?

Liquidator Benji Dymant, tasked with tracing the company’s missing millions, says creditors are owed £170m, with more than £100m due to investors. However, he concedes there is no evidence Dominguez pocketed significant amounts of cash. “We haven’t seen any bulk sums put into offshore accounts or anything like that,” he told Panorama.

Whether Dominguez orchestrated a premeditated fraud or simply lost control of an unsustainable business remains unclear. What is certain is that the man once hailed as “the Pied Piper of jewellery retail” lured some of Britain’s wealthiest and most experienced investors into a dazzling illusion—before disappearing without a trace.

Source – My News Ghana